What Should Your Taxes Go To?

Although about half of Americans complain about tax prices, and the complaint about taxes is a common trope aligned with Americans, taxes play a vital role in the government. The importance of taxes is to fund any endeavor the country wishes to pursue. Taxes are also used to support many social programs that help the working class through times of struggle. These social programs include bettering public education, health care, and even food banks.

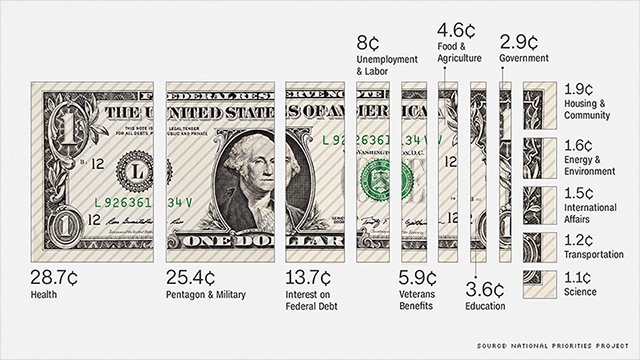

The allocation of the tax money given to the government is decided by lawmakers, yet billions of dollars continue to be directed to the military and police as opposed to social programs that can help people in need. For instance, over a tenth of federal tax money goes to the military-industrial complex as America continues to expand its unnecessarily large military. It can be extremely obvious as the US Department of Defense spends more on the military than the next 9 countries combined. The overwhelming amount of funding that goes to military spending could be used to help those in need or those in poverty. For example, many marginalized communities are in need of increased funding as they are disproportionally affected by poverty and poor funding for public welfare. For example, schools in white neighborhoods compared to non-white communities, are funded disproportionally to the degree of a $23 billion gap, favoring white neighborhoods. This extremely large funding difference demonstrates how American politicians continue to fund wealthy white neighborhoods as opposed to poverty-stricken non-white neighborhoods, seemingly giving working-class non-white Americans fewer opportunities than rich white Americans. This demonstrates that American politicians must increase tax spending on these working-class neighborhoods as they need these taxes more.

As seen, the working class needs the use of taxes more than upper-class people, this is not a reality as taxes continue to profoundly benefit-rich neighborhoods that do not need the funding as much as less fortunate neighborhoods. This is shown as poor neighborhoods pay their share in taxes, and need to use more of the tax fund as they need benefits in social programs such as public education, public housing, school programs (such as afterschool programs), and healthcare benefits. These government programs that the lower class relies on to support them are not funded enough, as funding continues to go to the police, military, and corporate subsidies. These 3 tax-funded programs all immensely benefit rich people over the lower class, as corporate subsidies are paid by taxes in order to benefit extremely rich businesses or offer these corporations tax breaks. The police and military benefit-rich neighborhoods over poor neighborhoods tremendously as well, as it is seen that the police are a force that protects the ruling class over protecting poor neighborhoods.

The use of American taxes is extremely important as it dictates what government programs will be funded. I urge people to contact their representatives and call for an increased allocation of taxes to be directed towards funding welfare programs that benefit the American people directly. These taxes will go to a more just use than funding an imperialistic violent military, that is already funded to an enormous extent. Simply allocating some of the fund for the military to social welfare programs will benefit thousands, possibly millions of lives.